The trap of our financial system and why crypto might be the solution

In this short read, I am going to outline how our financial system encourages risk-taking against long-term security and adaptability. Ultimately, making us reluctant to change and avoiding long-term benefits. This not only leads to an unstable society but also to one, in which

- Impulsive decision making is encouraged;

- Individuals are dependent on financial and legal middle-men;

- And above all, communities avoiding long-term benefits.

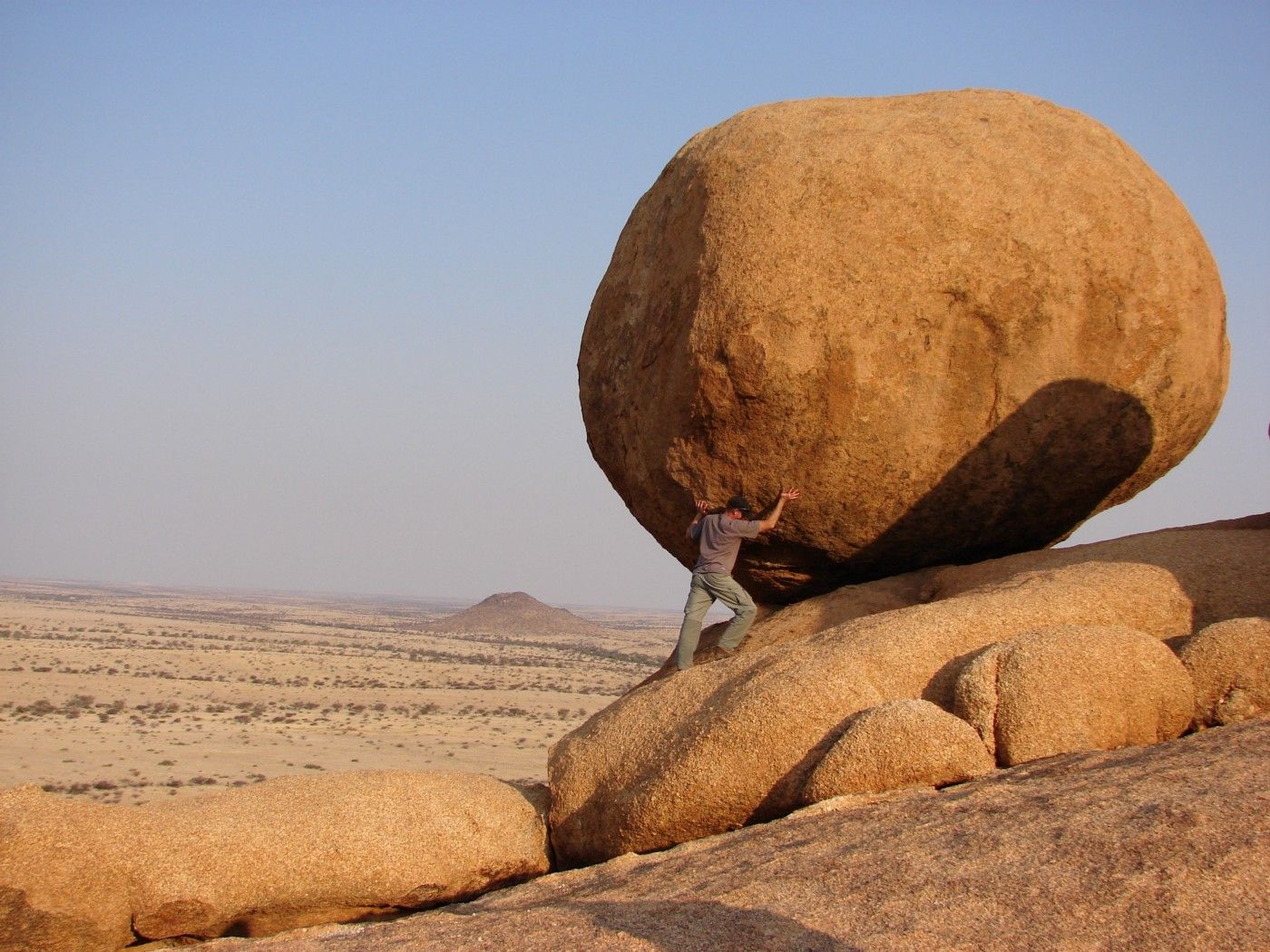

Embracing robustness to drive change

We can differentiate between efficient and robust actions. Efficient actions work really well when we can predict a future occurrence, allowing us to plan ahead. If we know the outcome of an event, we can plan for it accurately. This allows us to consider all aspects of the event that have to be taken care of, to run simulations, and ultimately, to deal with the event using the best knowledge and information available to us.

However, what if something unforeseeable happens? How are we going to react, and what are our options to control the outcome? In today’s world, there are hardly any events that can be predicted 100% accurately. Resulting, we are expected to prepare for all imaginable outcomes, which is hardly ever possible.

Without fixating on one single problem and an adequate solution, we are semi-prepared for several potential outcomes. By diversifying the risk of being unprepared for the event, we are not going to be surprised and helpless in the moment of change or uncertainty. This may be referenced to as robust planning.

The importance of adaptability

In the face of uncertainty, efficiency is no longer your friend. Instead, you will have to be reactive and plan for unforeseeable outcomes.

Great examples are the pharmaceutical industry, trade relations, the military, or disaster control. What is going to happen next, a tornado, a flood, wildfire a storm or an earthquake? The answer obviously varies on several factors, such as location and likelihood in the past. However, weather forecast beyond ten days only has a 50% chance of getting it right. With an increase in uncertainty through global warming, resulting in extreme weather patterns, the aim should be to prepare for all imaginable scenarios.

The difficulty of planning ahead

Our world has moved from being a complicated system to being a complex system. Complicated systems have various components that have to be understood, which requires coordination and expertise. Once this is done, identified patterns are likely to repeat themselves. Take, for example, a rocket; building a rocket is very difficult, but once you have a functioning model, you will not have to reinvent the wheel to build another rocket. In comparison, complex systems are based on interconnected entities, their relationship to each one another and individual properties. It’s similar to raising a child; the experience is always going to be different.

In complex systems, patterns are less visible; they do not become repeated and are more difficult to analyse and to act upon. A small occurrence might have a large, unanticipated ripple effect. Similar to when you throw a stone into water.

It (Efficiency) undermines and erodes our capacity to adapt and to respond. (Source)

So why are we constantly encouraged to plan for a certain outcome of events over the course of several years? Whether we plan relationships, careers, or our financial stability and investments, most decisions expand over the course of several years. By doing so, we align our future actions with our past, close ourselves off to opportunities, or if events do not turn out as expected, we are unable to respond.

While it was highly beneficial to be an expert in one field in the past, no matter the field of expertise you are in today, you will most likely be required to learn new skills and even change career paths in the future. Similarly, while the purchase of a property can mean long-term stability, in the case of adversary, such as flooding or you losing your job and being unable to pay for the credit, the plan can turn into a nightmare.

Most systems may have been efficient at their creation, in that they solved an individual problem, but have not been designed to be robust. By insisting on building efficient systems over robust systems, we are limiting ourselves, our community, and future generations to the information we had available in the past.

How our financial system encourages long-term risk-taking

Most likely you, or someone you know of, has bought something, which they could not afford at the moment, on a long-term deal, on credit. To take on credit, individuals rely on their situation either staying the same or improving in accordance to their past-decisions. The latter part being the most important.

Let’s take the example of city architecture, which is in most European cities evolving to becoming more pedestrian and bicycle-friendly, opening up the use case of e-scooters, and additional public transport. Overall, this development will be providing enough space and commuting options for making cars redundant. Cars will move from being a necessity to a convenience to becoming obsolete.

How does this sound to the average person living in the city, who has just signed a five-year loan on their brand new car? — Pedestrian-friendly city development, while benefiting the commons, will not be in favour of the individual car owner.

Governance and our Western financial money institutions sell their services by relying on a never changing, and if, then only slowly, course of events. While governments are busy keeping corporate interest aligned with topics that receive the most votes, and vice versa, banks aim to keep individuals dependent on financial middle-men.

Asset management has to be long-term. Otherwise, users may switch to alternative services. Being flexible and responding to change is not part of the sale package and would not bring as much revenue. Focusing on efficient planning, allows everyone to squeeze as much out of the resource allocation as possible. While this is beneficial to the middle-men, it likely will not pay off for the individual in the long-term.

The role of crypto

We have to break out of current power structures, to embrace creativity, to move towards robust decision making, and to open up the systems that we create today for the thought-leaders of tomorrow. While this is not a new concept, we have to keep reminding each other to question the things that “we have always done”. In particular, many blockchain projects are living this culture.

When we want to prepare for the future, we need human, messy, unpredictable skills. (Source)

Instead of practising just in time, we should focus on just in case management. Once we embrace the possibility of change, we will improve our ability to react better to unanticipated outcomes. We will become more creative, and ultimately, we will be able to evolve systems that are currently in place, on a much faster pace.

As I briefly outlined, our current financial system is dependent on us making decisions based on our current circumstances, which do not allow for long-term change. This is forcing us to stay aligned with our historical decisions instead of experimenting with and adapting to new circumstances.

Developers, researchers, analysts, designers, and everyone else who has been involved so far in crypto, contributed to an ecosystem that allows them to play around with alternative power structures and mechanisms. A great example of this is the Commons Stack. Their goal is to develop an infrastructure for humans to sustainably self-organise and manage shared resources. Read more on this here.

While the development of decentralised, peer-to-peer infrastructure is a work in progress, its success largely depends on the number of users, who make the switch and try out these systems. Any given system will not become usable without users. Thus, it is crucial to invest in user education and on-boarding, providing information on problems in established systems and the alternative P2P solutions may provide.

TLDR

Efficient planning is favourable when we know the exact outcome of an event. Not having to diversify available resources allows us to be better prepared for the given scenario. However, if we are unable to make accurate forecasts and to rely on our existing information, robust planning would be the better alternative. This requires us to adapt to a constantly changing environment.

Financial institutions depend on historical patterns and long business cycles to predict potential scenarios, offer services and react to change. This vastly limits an individual’s options of modifying their long-term obligations, such as credit, to respond to immediate change, which may result in long-term risk rather than stability.

Peer-to-peer systems largely embrace a robust approach to problem-solving. However, they require users to test and evolve mechanisms, which offer alternatives to current power structures, and to encourage users to switch from the comfort of efficient middle-men requires user education.

For future thoughts, follow me on Twitter.